We’ve all had to adapt – multiple times – to disruption over the last three years. With an energy crisis and recession, 2023 is already gearing up to be another year of uncertainty. These words from American baseball catcher, Yogi Berra, feel more relevant than ever:

“It’s tough to make predictions, especially about the future.”

Nonetheless, we couldn’t resist putting AccountsIQ’s Chief Revenue Officer, Nick Longden and COO, Darren Cran in the hot seat and asking:

What will be the most important and compelling issues for finance leaders in 2023?

Here’s what they had to say:

Prediction #1

The energy crisis will turn out to be positive – eventually

Darren Cran, COO, AccountsIQ

Darren Cran, COO, AccountsIQ

COO, Darren Cran, is quick to acknowledge that businesses in sectors from hospitality to manufacturing are being hit hard by the energy crisis. But on a more optimistic note he believes:

“Shocks can lead to some positive outcomes. The pandemic is a classic example. Alongside the personal trauma and economic stress, we all now recognise that it was a catalyst for digital transformation, flexible working and the adoption of Cloud technology.

Now, this crisis is leading to the fast-tracking of investment in renewables. All countries need to secure their energy supply and contain costs. The race is now on to see how quickly we can get there.”

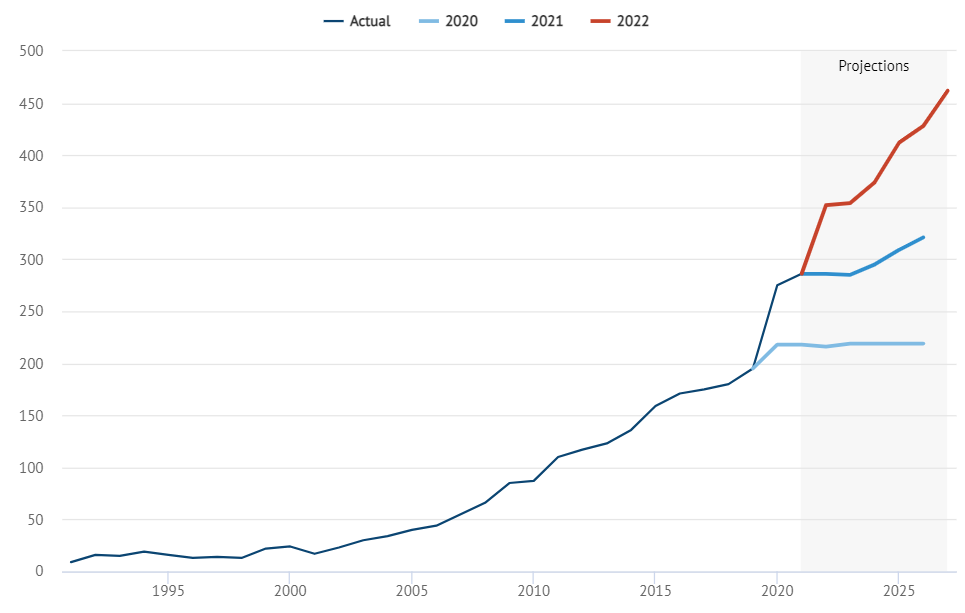

The International Energy Agency (IEA) has raised its forecast for global growth of wind and solar

Source: Carbon Brief 6.12.2022

Annual global growth of wind and solar capacity, 2000-2025. Actual growth is shown in black, while various IEA forecasts are shown in red and shades of blue. Source: Carbon Brief analysis of IEA forecasts.

Prediction #2

Technology is the answer to solving supply chain issues

Our reliance on complex, global supply chains was highlighted during the pandemic. We’re also continuing to see disruptions and increased costs in, for example, China. However, there are opportunities with emerging tech, such as AI and robotics, to re-shore production to Europe and benefit from shorter, more flexible and secure supply chains.

As Darren explains:

“We’re living through what are often referred to as VUCA* times. And the world is expecting more shocks. But these will be a catalyst for business model innovation. CFOs will be asking: ‘How do we do things faster and more sustainably?’ They need to do that because, in such volatile times, older, less sustainable business models will die out more quickly than we previously thought.”

*Volatility, Uncertainty, Complexity and Ambiguity

Prediction #3

There’ll be much more focus on Environmental, Social and Governance (ESG)

Nick Longden, Chief Revenue Officer, AccountsIQ

Nick Longden, Chief Revenue Officer, AccountsIQ

At Davos 2021, economist and former Bank of England governor, Mark Carney, declared the world to be at a ‘tipping point’ in the fight against climate change. We’re already seeing that the climate threat is changing consumer buying behaviour, as customers start to reject brands that don’t have a strong environmental story to tell. Our Chief Revenue Officer, Nick Longden, believes this will also become increasingly important in B2B markets.

“B2B buyers are starting to demand that their suppliers and partners have robust sustainability strategies in place. That’s often due to pressure from consumers, regulators, shareholders or other stakeholders. In the same way that B2B buyers might currently demand to see what data security policies you have in place, they will also start to expect you to have sustainable energy, supply chain and environmental policies, as they need to report on the sustainability of their full supply chain.”

How can CFOs prepare for more disruption in 2023

All three of our predictions involve major, long term business strategy and investment decisions. Inevitably, given the inflationary environment, many businesses will also be under pressure to manage short term costs. As such, CFOs will need the ability to differentiate between strategic investments that can boost long term growth and operational cost savings.

As business leaders increasingly look to finance teams for answers, advice and guidance, CFOs are ramping up their scenario planning and rolling forecast initiatives. Here are just a few of the strategic scenarios that finance leaders are likely to be tasked with solving:

- How do we collate historical and real time data to deliver insights on business trends, cashflow and variance analysis to compare performance with forecasts

- What is the cost/benefit analysis of our investment decisions, for example switching to an electric fleet or investing in solar panels?

- What is the ROI?

- What is the payback time of the investment?

- What grants or other funding options are available?

- How can we stress test each scenario?

“Most businesses are already aware of these issues,”

Says Darren.

“CFOs have been talking about them for some time. The difference is that now they are very real decisions that they are having to take. And, as they involve so many complex financial considerations, finance will need to have the relevant data to hand.”

Finance teams have always been a ‘window’ to the business; the portal where transactions from every department or entity are processed and monitored. Now, if they have the technology in place, they can harness this historical and real time data to provide vital insights. This enables finance teams to use their objectivity and analytical skills to collaborate, advise and add value across the business.

This demand for more advanced business intelligence and business partnering is also expanding the traditional regulatory and compliance role of accountants in practice, as Nick concludes:

“Accountants also have a crucial role to play as trusted advisers to their clients in turbulent times. There are the ones who will be ensuring businesses have the cashflow and forecasting data they need to make major investment decisions. They also provide an invaluable service as a neutral sounding board to discuss challenges and new ideas.”

Read more about the difference between strategic and non-strategic spending in our blog: Weathering the inflationary storm: 6 ways CFOs can control costs.

Thanks to Nick and Darren for your insights. We’ll be checking up on how accurate their predications are throughout 2023!

We’d love to hear your 2023 predictions

Email marketing@accountsiq.com with your Top Finance Prediction by Friday 6 January 2023. We’ll ask Nick and Darren to judge the most thought-provoking and send the winner something to celebrate with.