We were delighted to be an Event Partner at the RenewableUK Finance & Investment Conference, in London in November. As a member of the expert panel, our COO, Darren Cran, gave a presentation on:

How to maximise the returns on your renewable energy assets

If you couldn’t make the event, here are the three key takeaways from Darren’s talk.

1) Less admin, more insights

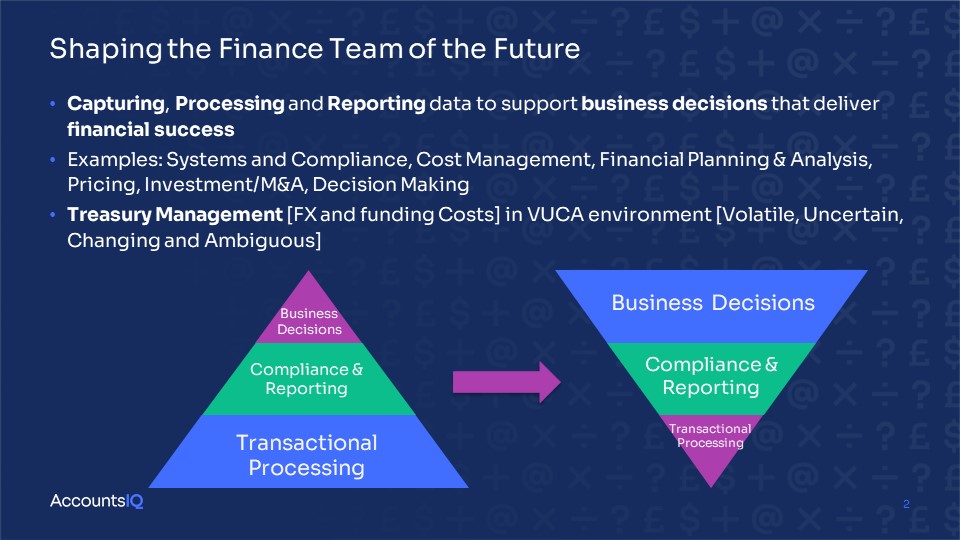

By leveraging technology, finance teams can shift energy and resources away from transaction processing to more value-added work. We call this ‘inverting the pyramid’. If you’re on a Cloud-enabled finance platform, with API capability, you can minimise the time spent on admin tasks and focus more on collaborating with internal and external stakeholders. That will enable you to ensure everyone has the right information at the right time.

The result will be faster, better business decisions based on data-driven insights.

Watch Darren Cran describe the impact of this shift on the business:

Renewable energy finance teams have specific challenges around complex cost management and pricing decisions, financial planning analysis and, increasingly, treasury management. AccountsIQ addresses these with significant automation, such as inter-company accounting, SPV accounting and Treasury FX consolidation, built into the platform. That brings major savings to finance teams alongside the ability to scale.

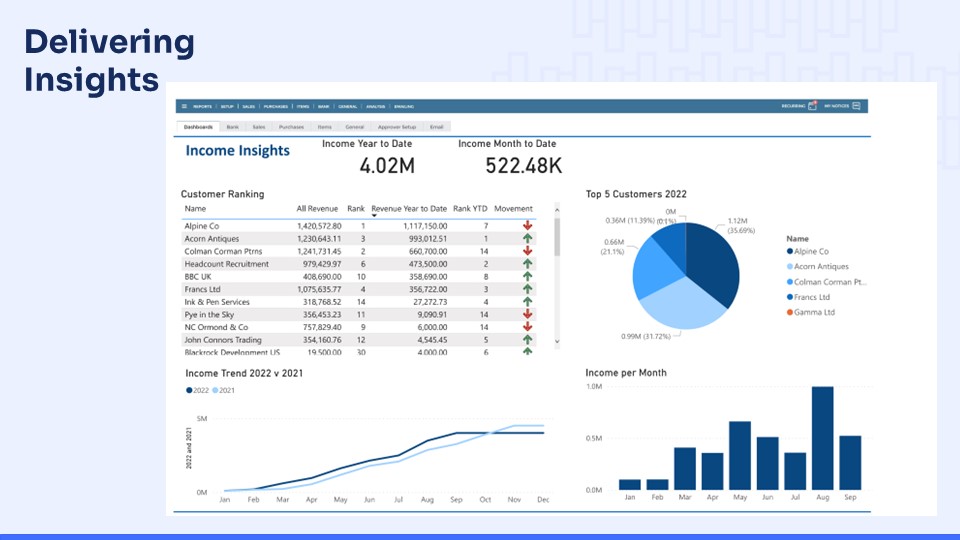

There is also a very strong API layer, so you can bring multiple data sources together. That means you can analyse much more than your compliance reporting; you can also do project finance and manage your portfolio by different asset classes, or measure returns across an entire portfolio. Crucially, it means you’re not operating with just static data; you can share trend analysis, identify exceptions and start to tell an enriched data story.

Here's an example of what that information can look like in an API world.

2) A culture of ‘always on’ change

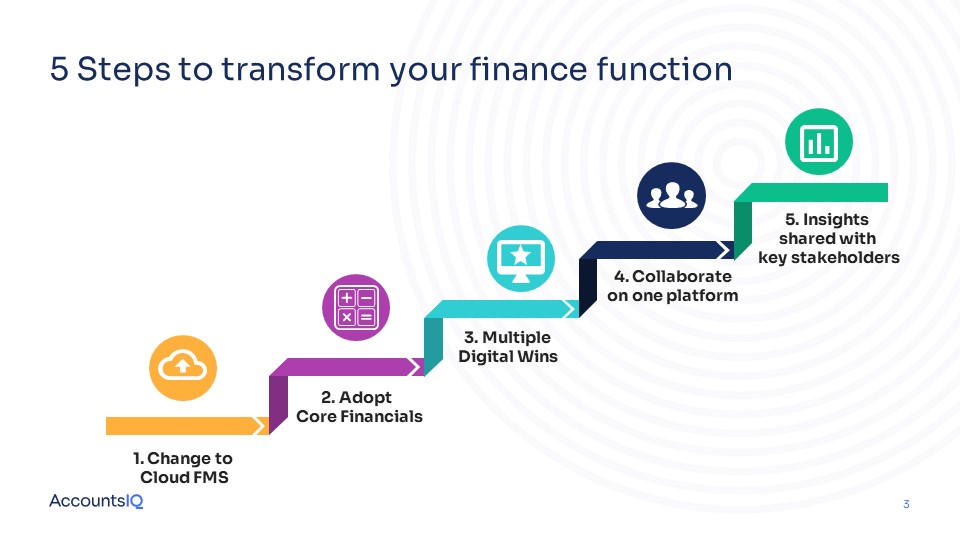

Adopting Cloud technology is the first, fundamental step to leveraging finance technology. But, to ensure continued engagement and improvements across the business, it’s also crucial to drive a culture of 'always on change'. As Darren explains:

“The worst thing you can do is have too big a scope for your finance digital transformation project. If you try to do too much, too quickly everyone gets tired. You're much better off having much shorter phases of change and keeping that momentum and culture of change going."

“That allows you to build on it with multiple digital wins. You get more collaboration on a single finance platform, and you start to share insights across different stakeholder groups.”

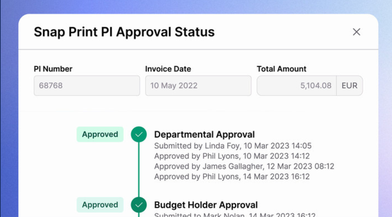

3) Spending visibility

Managers with budget responsibilities across the business need full spending visibility to identify cost drivers. Leadership teams also need to distinguish between strategic and non-strategic costs. Armed with this information, you can implement savings and efficiency plans while still directing investment to areas that are in line with your growth strategy and will bring higher returns.

Many thanks to RenewableUK for hosting a fascinating event.

Find out more about AccountsIQ’s Renewable Energy Accounting software and read our case studies for more real-world insights.