Finance automation isn’t new. If you’ve read our blog about the Mathematical Monk, you’ll remember that the 80s wasn’t just about big hair and shoulder pads. It was also the decade that saw PCs installed on many office desks, the launch of Lotus 1-2-3, Microsoft Excel, and some basic, stand-alone accounting software packages.

It didn’t lead to the finance function becoming redundant as many feared. In fact, accounting automation has always been more of an evolution. One that has enabled the accountants who embraced it to expand their role and influence across their business.

This article introduces some of the ways you can future-proof your finance function (and your career!). It covers:

- Which finance tasks can, and should, be automated (and those that can’t)

- Benefits of finance automation

- What to look for in a finance system

- Links to further resources, including our guide to Demystifying Finance Automation and Gearing up for Growth webinar recording.

Which finance tasks can – and should – be automated?

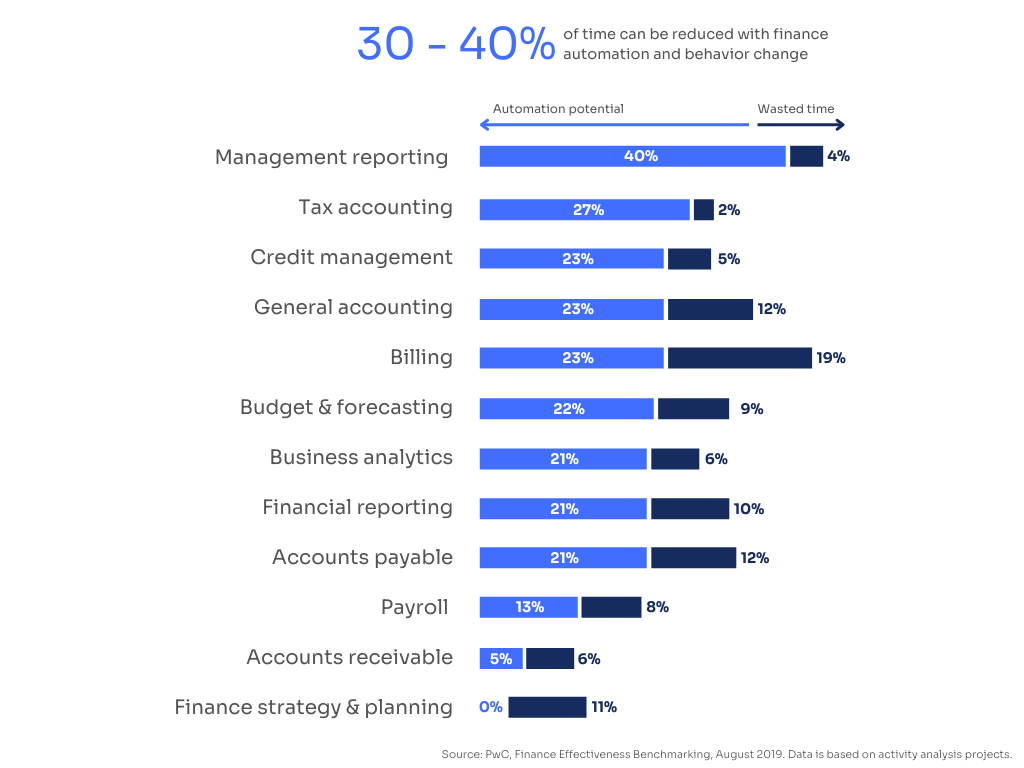

The effects of finance automation can be far-reaching, not least in its ability to save finance teams huge amounts of time. Many financial processes have a high automated potential, as highlighted below. According to a PwC* benchmarking study:

Finance tasks with particularly high automation potential are:

Let’s dive into some of these examples to see how finance automation can benefit common business practices.

Accounts receivable

Traditional accounts receivable processes can be time-consuming and prone to error. Accounts are often worked on across different departments or teams, which increases risk of mistakes and delays. Finance automation smooths out manual processes such as invoicing for easier cash flow management.

Payroll

Managing payroll is an incredibly important task, which is not only complex but time-sensitive. From various salaries, bonuses and work benefits, there’s a lot of room for error. Automating payroll takes the pressure off each month and ensures accurate, on-time payments across the office.

What is automation in finance?

Finance automation involves using software to redefine financial processes and operations. It can reduce manual, time-consuming administration duties, allowing workers to prioritise strategic tasks.

Benefits of finance automation

Some of the top benefits of finance automation include:

- Increased accuracy of data

- More time-efficient processing

- Reduced risk of fraud

- Improved decision-making and data visibility

It’s not just about saving time and money

Finance automation can reduce many manual, repetitive, day-to-day tasks, including error-prone data entry and number crunching. Instead, it makes it quick and easy for teams to create reports and provide insights and impactful analytics in just a few clicks. For you and your team, that means more time (and headspace) to do the things that really matter (and can’t be automated), such as analysing the data, formulating the strategy and communicating across the business.

Are 98% of managers failing at decision-making?

That figure sounds incredible. But, back in 2016, an HBR study found that only 2% of managers and executives regularly followed best practices when making business decisions.

The researchers gave several explanations for that figure. Many of them were cultural and behavioural issues. However, they did also note that:

“Enterprise software has automated many managerial tasks over the past 40 years. That shift has formed a foundation for better decision making, but it’s left the job unfinished.”

In other words, having the right technology in place isn’t ‘job done’ when it comes to making good business decisions. But it’s an essential first step. The crucial task of analysing and interpreting data generated by your finance system will always belong to the finance and leadership teams.

What to look for in a finance system

Before you start looking at different systems and software providers, we recommend you take some time to really understand your current finance processes and where they could improve. Where is your team feeling the strain and what gaps do you have in your data? When you understand the problems, you can look for the right solutions.

For example:

| Finance problem | Suggested solution |

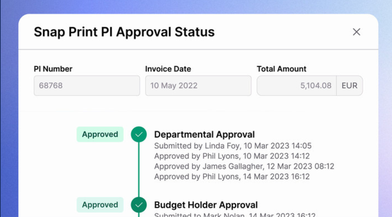

| AP team drowning in paperwork and manual approvals | Go paperless with document scanning and digital storage |

| Complex, time consuming expenses claims processes | Introduce a mobile expenses app your teams can use on the go |

| Manual data re-entry is leading to errors and data gaps | Look for a Cloud-based system that integrates with your other business systems, including your bank accounts |

| No time to provide useful, granular management reports and business intelligence | Choose a system with multi-dimensional analysis capabilities and pre-built, customisable reporting |

| Consolidated group reporting is a major month-end headache | Look for automated consolidation reporting software |

Once you start looking, you’ll find many other examples of finance tasks that could be improved or automated. After you’ve completed that process, here are some more tips for what to look for when narrowing your system search:

Tip #1 A system that’s been proven to work in a business similar to yours

You can filter these AccountsIQ Customer Case Studies by industry sector or systems integration to see if we might be a good fit for you.

Tip #2 Specific product functions that will help save time in your business

AccountsIQ customer, Integra Technical Services were keen to streamline specific processes in their finance function, such as multi-company accounting and foreign exchange. Integra’s Financial Controller, Sue Evans, finds that these features in AccountsIQ make her life much easier.

“We have a lot of inter-company trading and resource transfer. The process of re-charging costs and invoices across different entities is really smooth with AccountsIQ. It’s a big improvement from what we were using previously because I no longer have to log in and out to look at different entities.

“It’s also easy to map through and check you’re using the right FX. Previously, it was complicated, and we spent a lot of time working out variances. With AccountsIQ, you just know it aligns. In fact, we only need to do our FX updates monthly rather than daily. It’s so much better.”

Tip #3 A system that can scale

A finance system is typically a 5-10 year investment, so consider what functionality and software integrations you might need as your business grows.

Systems integration is a key element of finance automation. It enables you to connect data across systems to automatically populate your finance system and integrate with your financial reporting.

Here are just a couple of practical examples of how it can work:

- AccountsIQ partners with Plaid Financial, a world-leading open banking platform. That means customers can set up seamless connections between their finance system and their bank accounts. As a result, they enjoy the speed and convenience of secure, automated bank reconciliations and real time reporting.

Read more about Automated Bank Reconciliation Software.

- You can integrate a CRM system (such as Salesforce) with AccountsIQ. That enables you to create sales orders based on closed opportunities within Salesforce, and pass payments direct between the systems. You can also give your sales and account management teams access to vital customer information held by your finance team, such as balances and payment statuses.

AccountsIQ integrates with a wide range of Software Partners, so you can seamlessly link your finance system to your booking software, ecommerce platform, CRM system, EPOS, payroll system, and stock control. This eliminates the need for time consuming and error-prone data re-entry in separate systems.

Tip #4 A software partner who will support you through the onboarding, implementation and adoption process

System change projects often fail or stall not because of the technology but because the project isn’t properly resourced, planned and communicated. Watch this recording of our Implementing a New Finance System Webinar to find out more about how to make your project a success.

Demystifying finance automation

Automating your finance function shouldn’t be complex. We’ve put together our Demystifying Finance Automation Guide to help finance leaders through the process. It covers:

- Identifying where your finance function is straining

- Selecting a finance system that’s a good fit for your business

- Getting the coding structure right

- Building your automated workplace and onboarding a new system: capture, processing and reporting

- 7 steps to automating your finance function

- Customer case study: find out how leading IoT company, Asavie, automated many finance processes, including expenses, purchase order approvals and management reporting.

Download our Guide to Demystifying Finance Automation.

Find out more about finance technology

In our Gearing up for Growth webinar Katherine O'Carroll, Director, BDO's Business Services and Outsourcing team in the Technology & Advisory division, joined AccountsIQ's COO, Darren Cran to discuss the finance processes, technology and metrics that will enable you to scale successfully and futureproof your business.

Watch our Gearing Up for Growth Webinar.