Businesses are under increasing pressure to make swift, informed financial decisions. Yet, for many organisations, outdated manual approval processes continue to linger. With little time to adapt to clunky finance systems, finance professionals often revert to old ways of working. Slow approvals are an all-too-familiar frustration for finance teams. Beyond being tedious, they can restrict growth, limit cash flow visibility and create unnecessary friction across teams - particularly during periods of growth and expansion.

By adopting automated approval workflows, finance teams can tackle these challenges head-on. With better cloud-based technology that streamlines approval processes, businesses can gain greater visibility, improve compliance and ultimately enhance decision-making. But where should you start? The first step is pinpointing why traditional methods are holding you back.

The challenges with traditional approval processes

Manual approval systems often rely heavily on email chains, spreadsheets and disconnected systems. This fragmented approach creates several key issues:

•Stagnant delays: Approvals can stall when key approvers are unavailable, causing disruption to cash flow and supplier relationships.

•Lack of visibility: Finance teams often struggle to track the status of approval requests, leading to inefficiencies and missed deadlines.

•Compliance risks: Without clear audit trails and controls, businesses risk non-compliance and potential financial exposure.

•Error-prone processes: Manual data entry and disparate workflows increase the likelihood of issues such as payment errors or duplicated invoices.

The impact of automated workflows for your finance department

Automated workflows address these challenges by significantly streamlining the approval process:

•Faster decision-making: Automation eliminates the need for manual chasing and ensures approvers receive timely notifications. This speeds up the overall process and prevents important approvals from stalling.

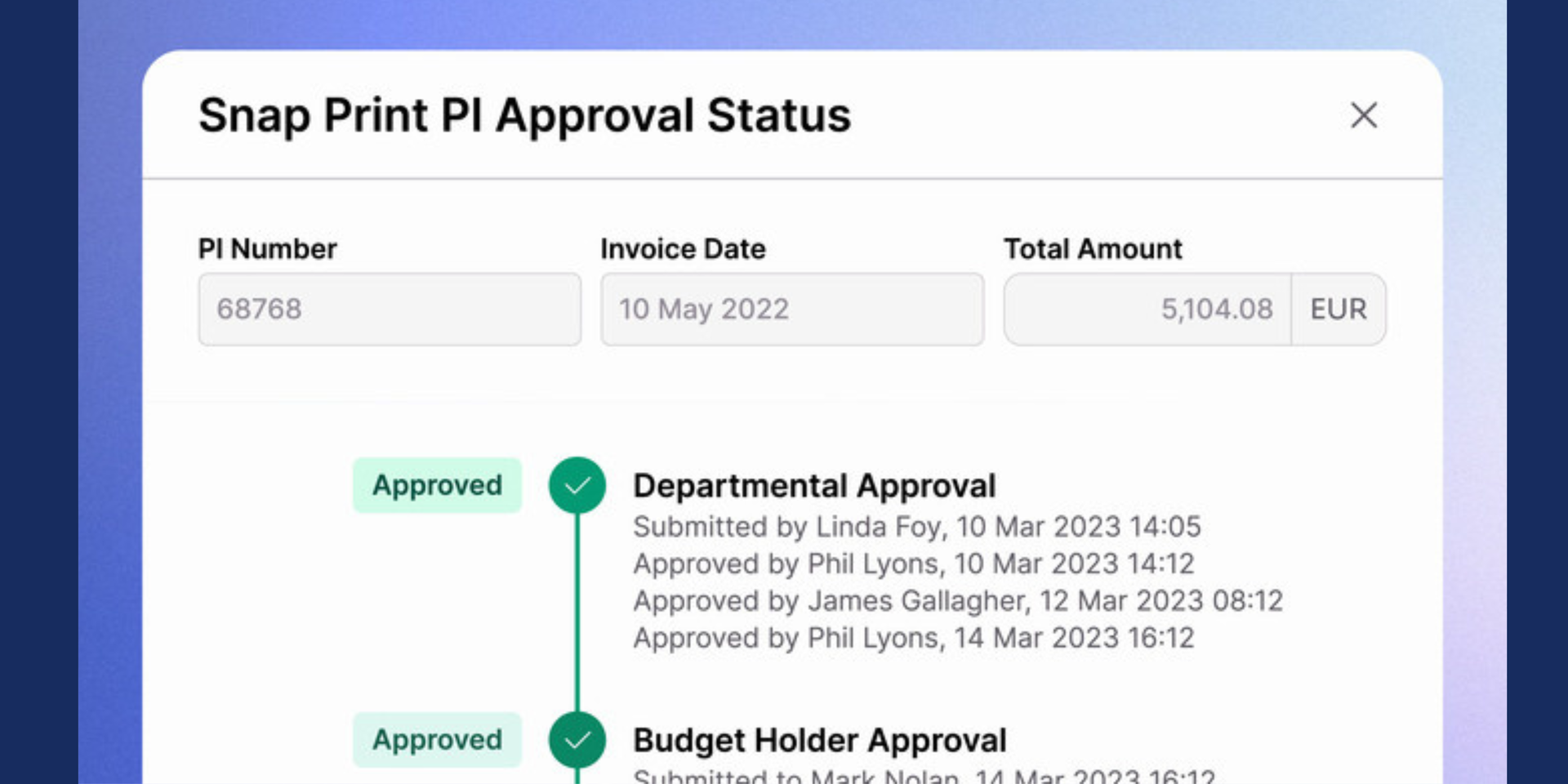

•Improved visibility: Real-time dashboards and reporting provide finance leaders with clear oversight of pending, approved and rejected requests. This ensures greater accountability and more informed decision-making.

•Stronger compliance controls: Automated workflows can be configured to enforce internal policies, ensuring every step follows the correct procedures. This audit-ready structure makes compliance easier to maintain.

•Reduction in manual tasks: By automating repetitive steps such as routing approvals or updating financial records, finance teams can spend more time on value-driven activities.

Enhancing the user experience for finance teams

The difference a modern automated workflow engine makes can’t be overstated. Intuitive interfaces allow finance teams to build and manage workflows easily, even with minimal technical knowledge, ensuring processes can evolve with business needs.

Key features that enhance user experience include:

•Customisable rules and triggers: Finance teams can define multi-step approval processes tailored to their organisation's structure and policies.

•Mobile approvals: Approvers can approve or reject requests directly from their devices, ensuring tasks progress smoothly even when team members are away from their desks.

•Budget visibility for approvers: By showing approvers the current budget status before approving a spend request, they can make better-informed decisions.

Future-proofing finance teams with automation

As the role of finance leaders continues to shift with new tech and growing demands across other areas of the business, automated processes are essential for maintaining growth, improving efficiency and staying in control of the finance function.

By adopting automated approval workflows, finance teams can leave behind gruelling processes, improve visibility between team members, and spend less time chasing manual processes. For businesses ready to enhance their finance operations, implementing automated workflows is a powerful step toward a more efficient and scalable future.

Unlocking new efficiencies with AccountsIQ's Workflow Approval Engine

For organisations aiming to modernise their finance operations, AccountsIQ delivers innovative, powerful, and product-driven solutions to streamline approvals. The new Workflow Approval Engine empowers finance teams with improved visibility, stronger compliance controls, and greater flexibility when designing approval processes.

Stay tuned for an exciting update on AccountsIQ’s latest release this week!