As your business evolves and grows into new regions and industries, so does the complexity of managing multiple entities. For CFOs and finance leaders, the year ahead promises a heightened focus on seamless multi-entity consolidation—a crucial process for maintaining clarity in a rapidly evolving financial landscape.

In this blog, we’ll take a closer look at what multi-entity consolidation looks like in 2025, why streamlined consolidation matters, and how the right metrics can empower you and your team.

Jump to section:

- Financial performance metrics

- Financial reporting and close metrics

- Predictive analytics and AI

- Entity-specific metrics

- Optimising your tech stack

Key metrics to track for multi-entity consolidation

To get the best view of a company’s financial performance, reporting efficiency, and operational health, CFOs need the right metrics on hand. From revenue streams to predictive analytics, these metrics provide actionable insights that drive strategic decisions—let’s dive in.

Financial performance metrics

From revenue streams to cash flow and intercompany transactions, these metrics are the foundation for smart decision-making and sustained growth.

- Revenue and profit margins: Understanding your organisation’s consolidated revenue streams is pivotal. Analyse revenue and profit margins across entities to identify growth areas, spot underperforming segments, and align your strategies accordingly. This data helps you evaluate the overall financial health of the enterprise while addressing discrepancies at the entity level.

- Cash flow: Effective liquidity management is the foundation of operational stability. Track cash flow across all entities to make sure that each one maintains the resources it needs. Multi-entity accounting software can simplify cash flow forecasting by providing real-time insights and centralised data access.

- Intercompany transactions: These are a common source of discrepancies in multi-entity setups. By closely monitoring and reconciling these transactions, CFOs can prevent errors, avoid unnecessary tax implications, and stay compliant.

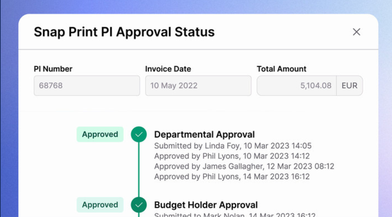

Financial reporting and close metrics

How long does it take your finance team to close the books? Tracking the efficiency of your financial close process can reveal bottlenecks and highlight opportunities to streamline workflows.

When working in fast-paced markets, having real-time data to back you up is invaluable. Use real-time financial reporting for more accurate decision-making and to keep stakeholders informed without delays.

Finally, adhering to IFRS, GAAP, and other global standards is non-negotiable. Having the right multi-entity consolidation software on your side allows for consistent reporting across jurisdictions, cutting the risk of compliance breaches.

Predictive analytics and AI-driven insights

A staggering 86% of CFOs feel decisions about financial strategy are made without sufficient data or insight. Luckily, AI-powered predictive analytics tools are here to help.

AI tools and predictive analytics (backed by AI) provide advanced forecasting capabilities, making it easier to translate the information you have into future-focused action. These tools use historical and real-time data to make more accurate predictions about financial trends, helping you and your team to be more proactive.

Here, use dashboards to consolidate key financial metrics into an easy-to-digest format, while data visualisation tools allow CFOs and finance teams to identify trends, anomalies, and actionable insights more quickly.

By using predictive models, organisations can better anticipate challenges and opportunities. From forecasting cash flow to projecting revenue, these insights allow finance teams to stay ahead of the game.

Entity-specific metrics

Staying ahead also means keeping a close eye on individual entity performance. Track each entity’s performance individually to get a detailed snapshot of your organisation’s overall performance. This also highlights how individual units contribute to the bigger picture.

Here, multi-currency operations can be a challenge, but tracking exchange rates and their impacts on financial performance is critical.

The right software simplifies multi-currency management, ensuring accurate and consistent reporting. Assessing the financial health of individual business units enables CFOs to make data-driven decisions about resource allocation, strategic investments, and divestments.

Optimising your tech stack and processes for smoother consolidation

Choosing the right consolidation software

Not all multi-entity consolidation software is created equal. Many packages are high cost, have long and complex implementation periods and often comprise far more functionality than companies actually need or use. When evaluating options, prioritise solutions that offer scalability, seamless integration, and robust reporting capabilities.

Your consolidation software should integrate smoothly with your existing tech stack, including ERP systems, payroll software, and other financial tools. Taking the time to find the right solution will pay off, reducing manual work and increasing efficiency across your finance function.

Using automation to boost efficiency

Automation reduces the time and effort required for tasks like intercompany reconciliations and financial reporting. This not only improves efficiency but also minimises errors—sounds good, right?

By centralising financial data and automating consolidation workflows, you can achieve faster close cycles and more accurate reporting. And with 85% of CFOs and finance leaders reporting that they need 1-2 extra days per week to clear their backlog, automation could be the key to a more streamlined process that frees up time for decision-making, strategy, and a better work-life balance to boot.

Multi-entity consolidation is about more than compliance

Tracking key metrics in multi-entity consolidation goes beyond ticking compliance boxes—it’s a strategic game-changer. With modern multi-entity accounting software, CFOs are empowered with real-time data and actionable insights that drive smarter financial planning and execution.

As we step into a new year, one thing is clear: in 2025 and beyond, leveraging technology and data will define the modern CFO’s path to financial excellence.

Ready to optimise your consolidation process? Book a demo to see how the right multi-entity consolidation software can accelerate your strategy in 2025.

Kelly Dent is a writer and editor with over 10 years’ experience across a range of industries, from accounting and AI to cloud technology, entrepreneurship, and beyond.