Financial Consolidation Software – No More Excel

-

Modern accountingUse our advanced accounting to close fast and share financial reports quicker than ever.

-

Group reportingConsolidation performed within AccountsIQ gets your group reporting done quicker and with less work.

-

Role-based dashboardsOur unique GL and BI layers combine to provide 24x7 reporting insight to your teams.

-

Integrated reportsAccountsIQ comes with over 250 pre-built reports to get you up and running quickly.

Consolidate at speed and with confidence

Automated consolidation is the dream of group accountants frustrated by archaic and manual processes. It means you can collate, evaluate and update all subsidiary information as accurately and as quickly as possible. With AccountsIQ’s combined accounting and consolidation platform, it’s just one-click to perform your consolidation(s) as often as you need. Read our customers’ stories below to learn how much time you could save.

Consolidate all key data for better visibility

When the Group FD has to wait until all the manual, consolidation spreadsheets are reconciled, audited and pre-processed who knows how accurate and useful the aggregate data is and if it’s still relevant. With AccountsIQ, you combine your accounting and business intelligence analysis into your regular consolidation. This means you produce not just the financial records but also management’s Key Performance Indicators (KPIs) to drive understanding.

Manage risk with faster consolidation

Access to accurate and up-to-date information about the financial impact of business activity can be the difference between good and bad outcomes. Do you have to wait until you have collated subsidiary data before you can form a group-wide view? By consolidating as often as you wish with AccountsIQ you will have near real-time access to inform rapid and better decision making.

Reduce costs by adopting digital transformation

Organisations without automated consolidation incur more cost. Manual capture and evaluation to combine results from multiple subsidiaries takes longer. With AccountsIQ, you can move all group accounting onto one platform. With common reporting and BI analysis structures, centrally managed FX and sophisticated inter-company transactions, you’ll perform faster and more robust consolidations at considerably lower cost and boost finance team morale.

-

Automate consolidation

Many accountants manage their financial consolidation by simply amalgamating accounts rather than having a system which can automate more complex protocols whilst providing real-time reports - with just one click.Download Consolidation Guide -

Gain clarity

AccountsIQ cloud consolidation software removes frustrations by enabling true and timely complex financial consolidation. AccountsIQ gives you clarity through your Group accounts in real time and handles all your currencies - with just one click.Download Group Finance Guide -

Unique coding

We’ve tackled the problem in a unique way. By linking the subsidiary-level ledger codes to a common set of group, summary codes, AccountsIQ cloud consolidation software allows your subsidiaries to benefit from individual local coding while you retrieve and drill-down to the data that you need - with just one click.Download Consolidation Infosheet

What you need from your financial consolidation software

-

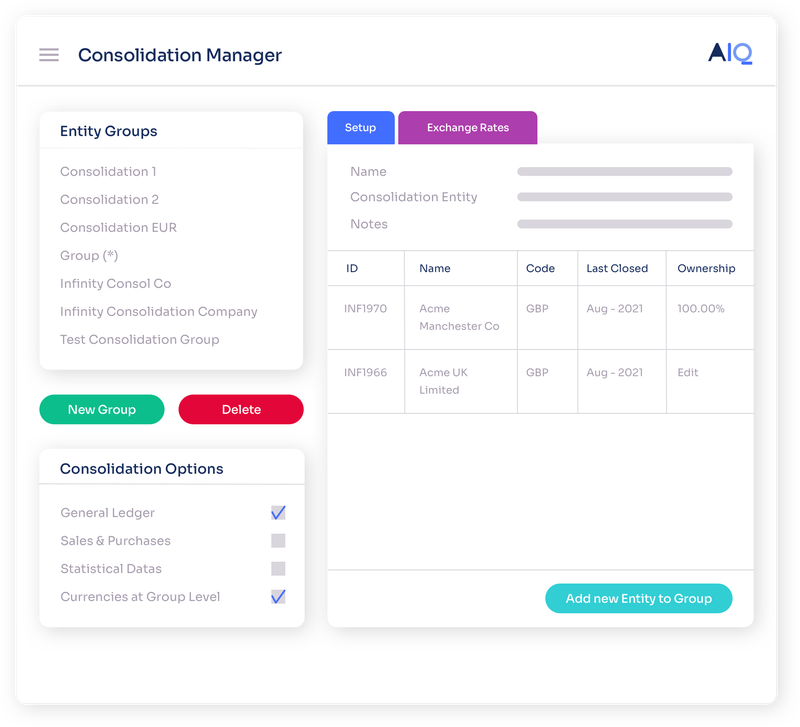

Consolidation of multiple subsidiaries (incl sub groups)

Engineered for large number of subsidiaries with ease. Handles sub groups where the consolidated entity becomes a subsidiary of a large group consolidation. Ideal for complex corporate structures. Subsidiaries can use AccountsIQ as their primary accounting system. -

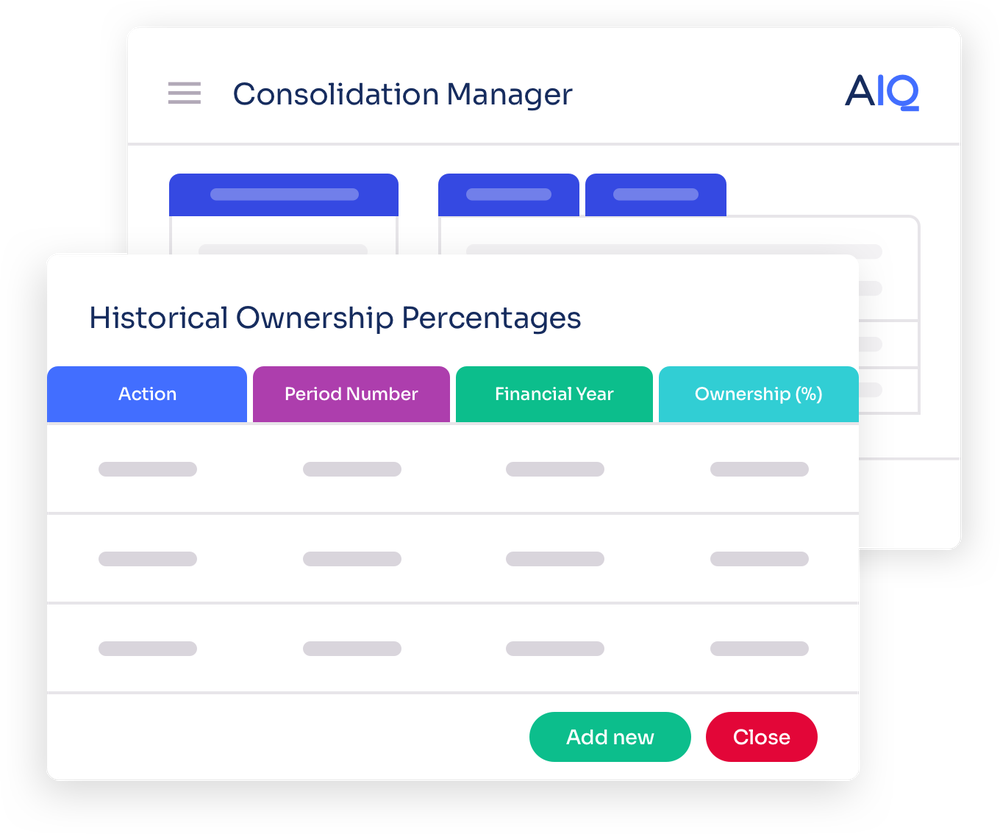

Manage complex ownership arrangements

Automatically recognises Minority Interests liability if the ownership is greater than 50% but less than 100% and creates relevant postings in the consolidation entity. -

Foreign currency consolidations with ease

Subsidiaries operate in their own base currency and results are translated into the base currency of the consolidation entity, based on stored exchange rates for each reporting period. P&L accounts are translated using average period rates and Balance Sheet accounts use period end rates. -

Centrally control exchange rates

Save time and maintain average and period end exchange rates centrally to automatically propagate rates to all related subsidiaries. -

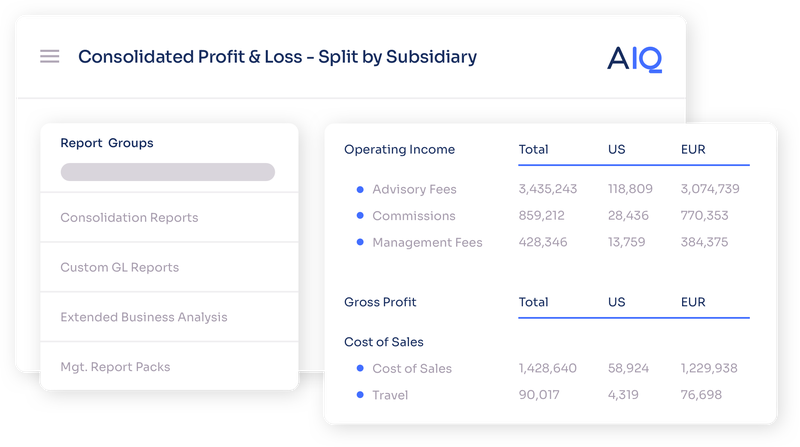

Reports on actuals vs budget by BI analysis at group level

Budgets, revised budgets, actuals and variances are rolled up from subsidiaries to provide an overview of performance and trends across the group, at any time. Consolidation includes BI analysis as well as GL Chart of accounts enabling group-level BI reporting and dashboards. -

Simplify inter-company charge posting

Raise inter-company sales invoices that automatically create purchase invoices in the “receiving” company. Purchase invoices remain unposted until accepted and coded in the receiving company. Inter-company accounts remain balanced for elimination at group level for foreign currency balances. -

Month-end currency revaluations

Simplify revaluation of foreign currency bank, debtor and creditor accounts at subsidiary level based on centrally maintained exchange rates. Unrealised gains and losses are automatically posted. Base currency values of assets and liabilities are adjusted prior to consolidation facilitating elimination of inter-company balances at group level. -

Group sales & purchase analysis

Consolidate sales and purchase analysis to allow group-wide reporting and benchmarking. Useful where common products/services are involved. -

Post consolidation adjustments

Make adjustments at group level to eliminate inter-company profits at group level without affecting subsidiary figures.

AccountsIQ platform concepts

Top 10 benefits of automating your Group consolidation with AccountsIQ

What our customers say

"AccountsIQ’s main success for us has been the efficiency it has brought to the business. The product is a good fit for our pretty complex accounting requirements and AccountsIQ gives us real value for money. We can consolidate 80 entities in a few minutes." Lee Camp, Finance Director, Salamanca Group

Combined accounting, consolidation and business intelligence in one platform

See all case studies-

Thermatic Technical

Thermatic engineering group opened up a new world of multi-dimensional management reporting with AccountsIQ after Sage 50 couldn’t cope with …Find out more -

Salamanca Group

Merchant banking business Salamanca Group comprises approximately 80 businesses. Switching from Sage 50 to AccountsIQ means consolidated management reports can …Find out more -

Apera Asset Management

Apera Asset Management chose to move from Xero to AccountsIQ when consolidation became too cumbersome.Find out more -

Getech

Moving four legacy systems from QuickBooks and Sage onto AccountsIQ has resulted in huge time-savings for this global company.Find out more

Automate consolidation and get better financial insights

Book a consultation and demo

Related articles

-

Consolidation | Mar 2022

Consolidation | Mar 2022How to prepare group consolidated accounts

Find out more -

Blog | Sep 2021

Blog | Sep 2021How automated consolidation and reporting can save you a week’s work – every month

Find out more -

Blog | May 2020

Blog | May 2020Automating financial consolidation and reporting with award-winning financial consolidation software

Find out more -

Blog | Feb 2016

Blog | Feb 2016Multi entity consolidation: ensuring efficiency, accuracy and timeliness

Find out more