The role of the CFO has never been more important—or more adaptable. As economic landscapes evolve faster than ever before, finance leaders are tasked with navigating complex challenges that demand strategic thinking, technological insight, and increased flexibility.

It comes as no surprise, then, that at least 63% of CFOs claim they feel overwhelmed by the financial challenges facing their organisation multiple times a month, while a quarter (25%) saying they feel this way several times a week.

In this article, we’ll check out the top 5 economic challenges CFOs and finance leaders face in 2025, with some insights into how you might navigate them effectively.

The top 5 economic challenges CFOs face in 2025

1. Economic uncertainty

Economic uncertainty has been around, weaving through the decades, for as long as humans have used currency. But post-pandemic it has become the norm, and financial planning has morphed from a predictive exercise to a delicate risk-management form of accountancy art.

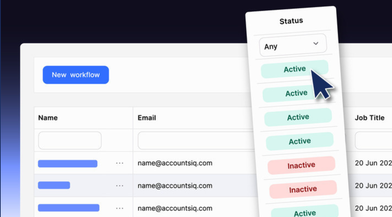

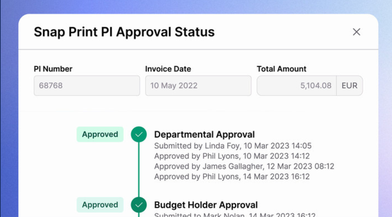

CFOs are now expected to have robust scenario planning capabilities that go beyond traditional forecasting. Leveraging advanced financial accounting software has become crucial in this endeavour, allowing for real-time data analysis and quick, strategic pivots.

To thrive rather than survive, finance leaders today need to look at this uncertainty not as a threat, but as an opportunity for innovation. But how can they aim for better and achieve more while navigating frequent changes and sometimes unexpected roadblocks?

With the help of comprehensive accounting and financial management software, ambitious finance teams can create multiple financial scenarios, stress-test the possible outcomes, and respond with agile strategies that safeguard short-term stability and boost business performance, without compromising long-term growth.

2. Balancing strategic and business investment

Striking the right balance between strategic and operational investments has never been more challenging. CFOs and other finance leaders now have to act as business advisors, carefully digging into investment opportunities through a lens of immediate implications as well as considering future potential.

This calls for an approach that moves beyond traditional financial management and into something more holistic. To that end, accounting and financial management software can be an invaluable tool in this process, providing cutting-edge analytics that support CFOs in making better, more informed and data-driven decisions.

The aim here is to craft an investment strategy that balances risk mitigation against growth potential, making sure that every financial commitment pays into the company’s broader strategy and objectives.

2. Balancing strategic and business investment

Striking the right balance between strategic and operational investments has never been more challenging. CFOs and other finance leaders now have to act as business advisors, carefully digging into investment opportunities through a lens of immediate implications as well as considering future potential.

This calls for an approach that moves beyond traditional financial management and into something more holistic. To that end, accounting and financial management software can be an invaluable tool in this process, providing cutting-edge analytics that support CFOs in making better, more informed and data-driven decisions.

The aim here is to craft an investment strategy that balances risk mitigation against growth potential, making sure that every financial commitment pays into the company’s broader strategy and objectives.

3. Interest rate fluctuations and cost increases

Our inaugural CFO Mindset Report found that when it comes to challenges facing their finance function, 40% of CFOs said that “inflation and rising costs impacting profitability” were the main issues keeping them up at night.

Volatile interest rates continue to raise significant challenges for financial planning. CFOs need to develop sophisticated hedging strategies and maintain exceptional financial flexibility to mitigate potential risks. This means not just reactive measures, but proactive financial engineering that anticipates and neutralises potential economic disruptions, leading to smarter decisions and prolonged success.

Accounting software for financial advisors has evolved to provide sophisticated modelling capabilities, allowing finance leaders to simulate various interest rate scenarios and their potential impacts.

Having these advanced tools in their back pockets empowers CFO to develop comprehensive strategies that protect organisational financial health without giving up competitive momentum and agility.

4. Digital transformation and advanced analytics

A staggering 86% of finance leaders feel decisions about financial strategy are made without sufficient data or insight. It comes as no surprise, then, that digital transformation is no longer an optional strategy but a non-negotiable for leadership.

With advanced analytics and artificial intelligence revolutionising decision-making processes, finance leaders are well placed to provide next-level insights and inform strategic decisions across their organisations. CFOs who successfully integrate these types of cutting-edge solutions can transform their finance departments from traditional accounting centres to strategic innovation hubs.

It’s worth remembering that this involves not just rolling out new technologies, but nurturing a culture of continuous learning and technological adaptation to back it up. If your team is trained up and confident in the technology they’re using, the entire organisation will reap the rewards.

5. The talent gap and leadership expectations

The evolving technological landscape has created a significant talent gap in finance leadership. Modern CFOs are expected to be half-financial expert, half-technological strategist and all-around organisational innovator.

This calls for a multi-faceted approach to talent development and recruitment. To achieve this, organisations need to do three things: invest in continuous learning programs, create cross-functional training opportunities, and develop comprehensive talent strategies that attract and retain multiskilled finance professionals who can navigate the complex economic landscape of 2025.

What’s next for savvy CFOs?

As we navigate the intricate economic challenges of 2025, the most impactful CFOs will be those who don’t view uncertainty as a threat, but as an opportunity. They’ll leverage advanced technologies, and maintain strategic flexibility to weather any financial storm. They understand that with the right foresight their company finance function can be better simply by implementing software and tools that can not only boost performance but also reduce stress and increase productivity in teams, allowing them to both work and live better.

Finally, the future of financial leadership lies not in predicting the perfect, most precise path forward, but in building organisational resilience and adaptability. By integrating sophisticated financial technologies, leaning on comprehensive scenario planning capabilities, and building a culture of continuous innovation, savvy CFOs can turn economic challenges into opportunities for fantastic organisational growth.

Find out more about the challenges CFOs are facing and how to navigate them in our CFO Mindset report.

Book a demo today to see the AccountsIQ platform in action.

Kelly Dent is a writer and editor with over 10 years’ experience across a range of industries, from accounting and AI to cloud technology, entrepreneurship, and beyond.