"Slow approvals cost more than time – they cost growth," says AccountsIQ CEO

Slow approval processes have long been a barrier to finance team productivity across industries. With Darren Cran warning of their impact, we at AccountsIQ set out to eradicate the problem of approval delays with the launch of a smarter workflow solution designed to boost efficiency and give finance leaders more control.

The problem: approval delays are slowing business growth

As finance leaders and their teams increasingly rely on powerful finance tech to make data-backed decisions, the need for faster, more efficient approval processes has never been more critical. However, many businesses are still struggling with outdated, manual workflows that lead to unnecessary delays and missed opportunities.

As Darren Cran puts it: “Slow approvals cost more than time; they cost growth.” Any delay can have a significant impact on a company’s ability to scale and remain competitive.

The solution: AccountsIQ’s new workflow approval engine

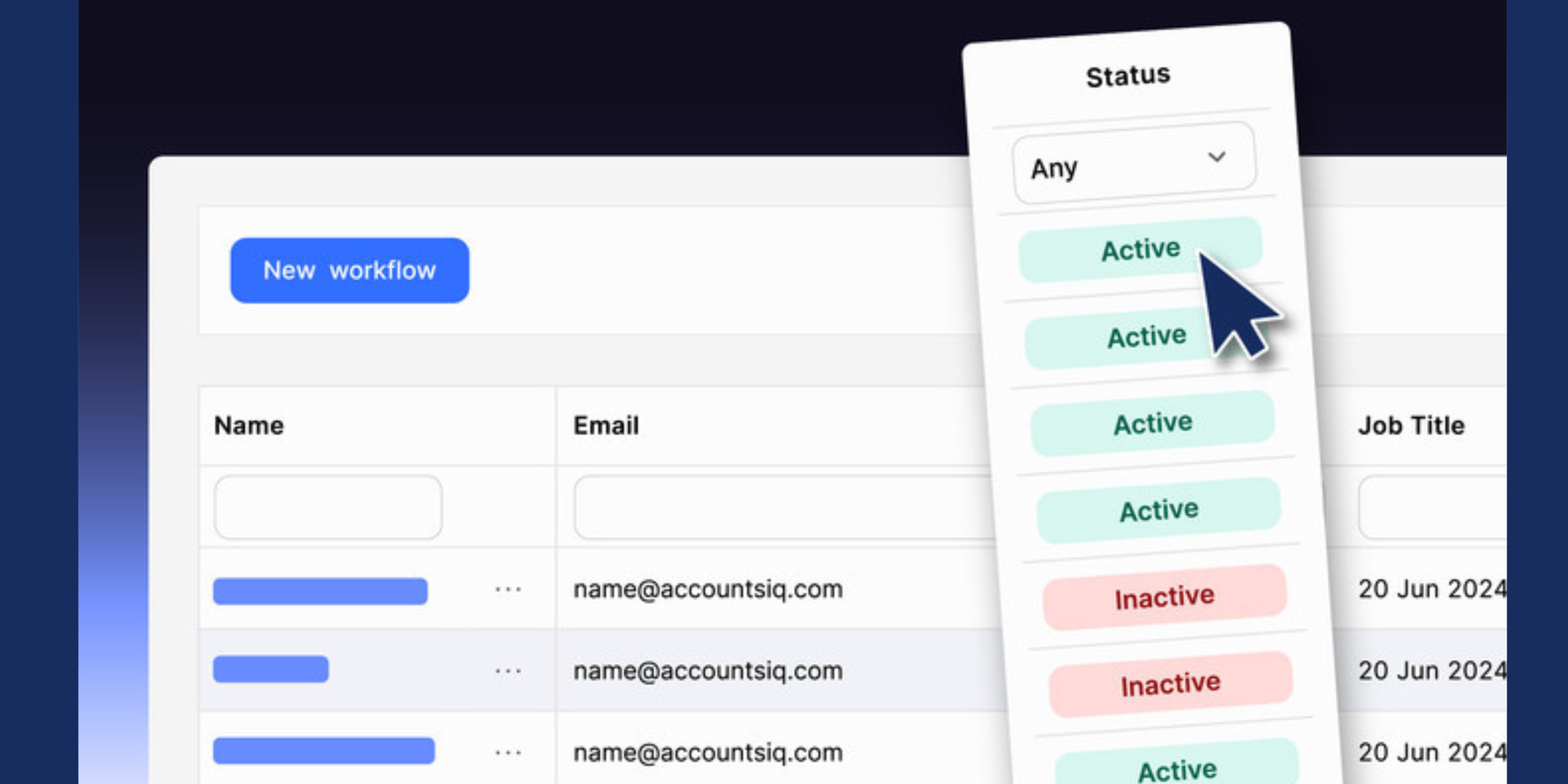

At AccountsIQ, we understand these challenges – and we’re here to help. We’re excited to introduce our new workflow approval engine, a powerful tool designed to transform how finance teams manage approvals. The engine streamlines financial workflows, improves compliance and enhances visibility, all while reducing reliance on manual processes.

By automating approval processes, the workflow approval engine enables faster decision-making, fewer errors, and smoother progress on tasks. It’s a game-changer for finance teams looking to get more done while ensuring everything stays on track and is accurately recorded.

Customisable, flexible and tailored for your business

One of the standout features of the workflow approval engine is its flexibility. The engine allows businesses to create customisable, multi-step approval workflows that align with their unique needs. Whether you’re managing a single entity or a complex multi-entity structure, the engine adapts to your requirements, making it easier to transition from legacy systems with minimal disruption.

This level of control ensures finance leaders have the visibility they need to guarantee each step of the approval process follows internal policies and remains compliant with regulations.

Empowering CFOs and finance teams for the future

As CFOs and finance leaders take on more strategic roles within their organisations, the tools they use need to help them perform more efficiently – not get in their way. Darren Cran emphasises this: “Our mission is to make their work easier and more efficient, ensuring they can add more value to the business with finance as a central function. The workflow approval engine does exactly this.”

Beyond just improving efficiency, the engine enhances compliance by offering real-time insights into approval progress. This means that finance leaders can rest assured knowing all approvals are transparent, well-documented, and compliant with audit requirements.

Ready to streamline your approvals?

At AccountsIQ, we’re all about supporting growth. With the new workflow approval engine, we’re making it easier for businesses to streamline their approval processes, reduce delays and stay compliant – all while gaining better control and visibility.

Want to see how it works? Watch our recent webinar, 'The key to smarter workflow approvals', where our experts will show you how to streamline approvals, improve compliance and fully leverage the flexibility of our workflow automation tools.