Waiting until year-end to upgrade finance systems is a dated process, quickly being left behind by businesses and practices looking to stay ahead of the curve. Although classic finance systems often feel safe, in reality, they are often what are holding your business back. As experts in the field, we’re here to explore why it's essential to break free from this cycle. First, we’ll unpack the drawbacks of waiting until year-end, and in turn, highlight the advantages of making changes outside of the typical year-end crunch. Additionally, we'll share success stories of businesses that benefited from early transitions, including improved reporting and decision-making.

The drawbacks: what impact does delaying until year-end truly have?

Missed opportunities

Delaying your finance system upgrade until year-end means missing out on opportunities to streamline operations and enhance efficiency throughout the year. Businesses that wait and stick to traditional systems can risk falling behind competitors who adopt a more agile financial management software.

Data integrity issues

When you leave system upgrades until year-end, you might experience potential data integrity problems. Errors may accumulate, making it harder to identify and rectify issues before they snowball into significant financial discrepancies.

Year-end overload

As any business or practice owner knows, the year-end crunch is real. Waiting until then can overwhelm your finance team with excessive work, increasing the likelihood of errors and oversights in financial reporting and consolidation.

Inefficient decision-making

Outdated financial management software may hamper your ability to make informed, data-driven decisions throughout the year. This can lead to missed growth opportunities and potential financial setbacks.

The advantages: making the transition to our all-in-one platform

Improved workflow

Upgrading your finance system outside of the year-end rush allows you to implement changes systematically, reducing the risk of disruption to your daily operations. This approach can lead to a smoother transition and minimal downtime.

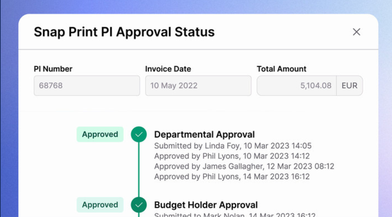

Timely reporting

With a modern finance system in place, you can generate accurate financial reports on demand. This empowers your team with real-time data, enabling quicker decision-making and better adaptability to market changes.

Enhanced data security

Regular upgrades ensure that your finance system remains secure and up-to-date, reducing the risk of data breaches.

Competitive edge

By staying ahead of the curve, you gain a competitive edge in the market. You can respond more swiftly to changing economic conditions, making it easier to seize opportunities and mitigate risks.

The advantages of upgrading your finance system outside of year-end far outweigh the drawbacks of maintaining the status quo. Timely upgrades lead to improved workflow, better decision-making, and a competitive edge, all of which contribute to enhanced success that’s visible from the get-go. Take inspiration from success stories from our satisfied clients, who left behind old traditions without having to take a risk, as AccountsIQ guarantees a transition that’s seamless. Take control of your finance system management today, and see the difference with AccountsIQ.